Price Is What You Pay, Value Is What You Get: Choosing an Advisor

Adam Drake • April 4, 2025

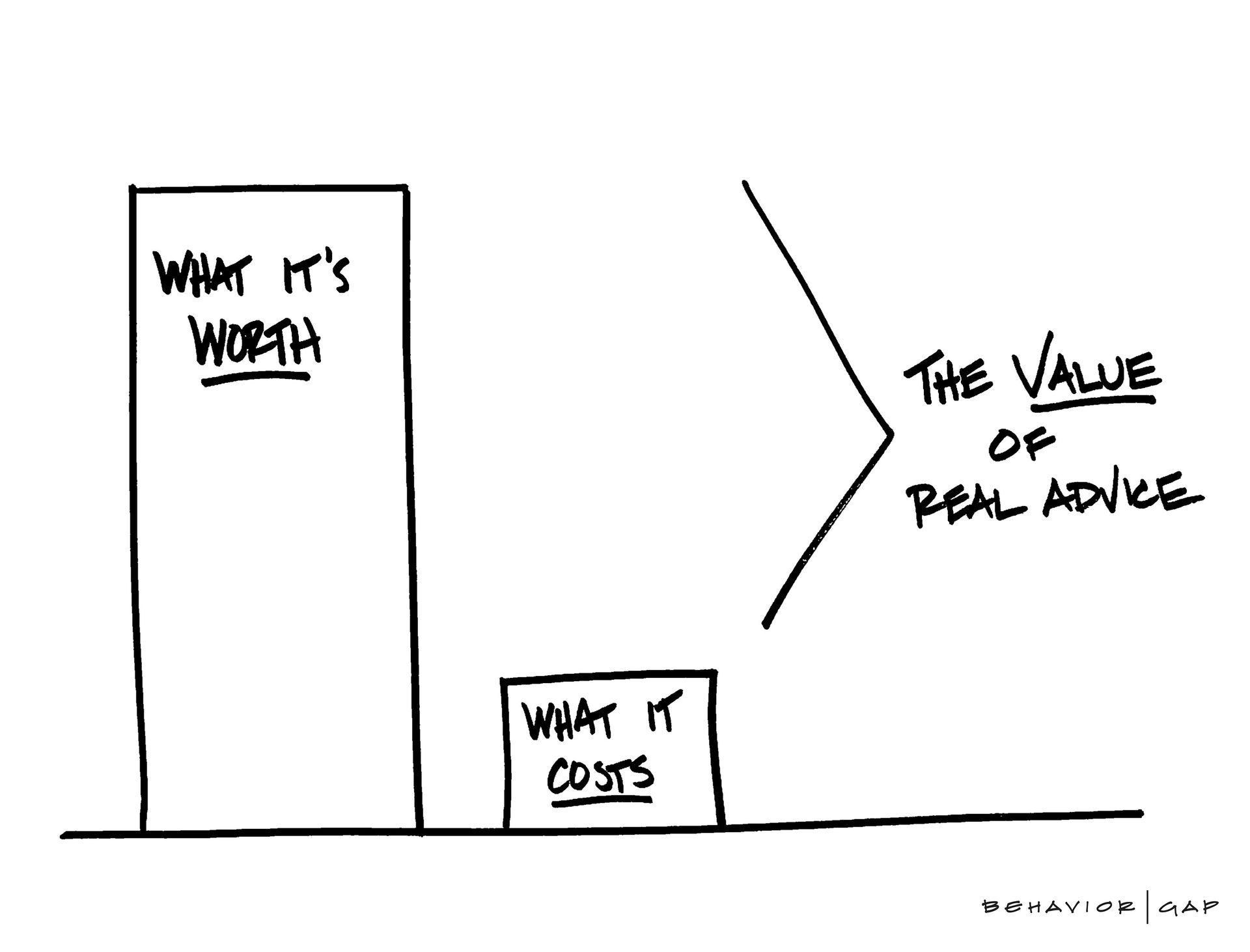

Warren Buffett famously said, "Price is what you pay, value is what you get." Yet, too often, decisions are made with price as the only factor, overlooking the real value behind a choice.

We recently had a prospective client call us with only one question: how much are our fees? Unwilling to engage further in a conversation to understand what we offer, they simply stated, “Your fees are higher than the other firm, I’ll go with them.”

It’s understandable that people want to compare costs, but a decision based solely on price can overlook critical factors. I suspect the prospective client may have had bad experiences with pushy salespeople in the past—perhaps even financial advisors—which is unfortunate. But making decisions about your financial future requires more than a surface-level comparison.

Choosing a financial advisor isn’t like picking out a refrigerator at an appliance store. If you end up with the second-best fridge, your life won’t be significantly impacted. But selecting the wrong steward for your capital could have far-reaching consequences. The cost of fixing bad advice can be higher than the additional cost of good advice. The time spent researching and interviewing financial professionals should reflect the gravity of the decision.

While some of the value of financial advice can be measured in dollars, much of it not economic. There is value in the peace of mind that comes from someone who can help you better understand the alternatives available, and the risks involved.

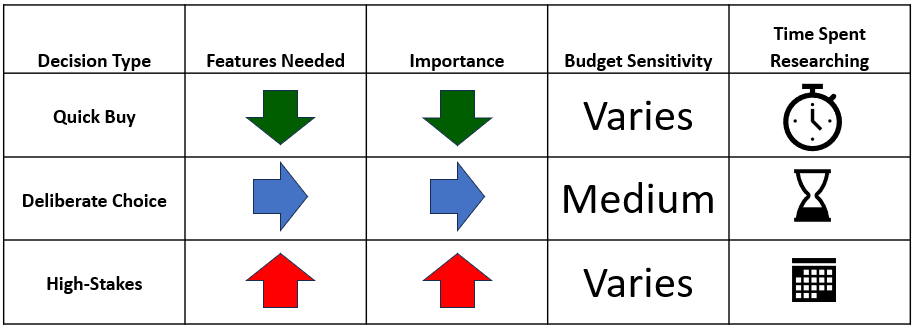

The Decision Tradeoff: Price, Features, and Importance

When making a decision, we often weigh three key factors: price, features, and importance. The right balance depends on what you value most. But another critical element is time spent researching—because at a certain point, additional analysis leads to diminishing returns.

Below is a framework for thinking through decisions based on these factors.

The 80/20 Rule in Decision Making

A useful guideline is the 80/20 rule: 80% of the value in a decision comes from the most important 20% of factors.

When evaluating financial advisors, that 20% likely includes trust, expertise, alignment with your goals, and fit for you—not just cost. Ask yourself if you can work with this person for the long-run.

If 80% of your confidence in a decision can be reached with reasonable effort, stop researching and commit. But if you're making a high-stakes decision, investing extra time to ensure you’re choosing wisely is well worth it.

Ultimately, choosing an advisor should be based on a holistic evaluation, not just a number. The best decisions are made when you balance cost, value, and the importance of getting it right.

Recent market volatility had the S&P 500 flirting with Bear Market territory. At one point intraday, the S&P 500 was down by -20% from the all-time high. What is a Bear Market? The term dates back to the 18th century to describe a market that has declined by at least -20% from the previous peak. The official definition requires the market to have finished the day down by at least -20%. So, while the S&P 500 is not technically in a Bear Market (as we write this on April 23rd, 2025), it is exhibiting the symptoms of a Bear Market. What typically happens during Bear Markets? Bear Markets are characterized by extremely high volatility with big swings in price, in both directions. Bear Markets have produced the largest single-day losses as well as the biggest single-day gains. It can get very confusing. It is possible the economy will subsequently experience a recession, but it is not a requirement for a Bear Market. For example, during the 2022 Bear Market, the U.S. economy did not contract to the point of recession. Bear Markets without recessions have historically been shallower declines with a faster recovery. It is also possible that a Bear Market is what causes a recession due to negative wealth effects causing businesses and consumers to cut spending, contracting the economy. Weird things can happen in Bear Markets. Historical relationships between various assets can change. Bonds had offered stability in portfolios when stocks were down—until the 2022 Bear Market when both lost a significant amount of value. In the 2008 Bear Market, frequently referred to as the Global Financial Crisis, real estate prices fell across the United States, which had never happened before. “Things” frequently “break” in Bear Markets due to the wide swings in price and lower liquidity. Financial markets may not function as expected. During the 2020 COVID Bear Market, futures contracts for West Texas Intermediate crude oil briefly traded at a negative price. In the 2008 Bear Market, previously safe money market funds lost enough to break the buck and fall below $1.00. In Bear Markets, it is common for someone to say that “It’s different this time” and then point to the weird and broken things as justification. Claims are made that buy-and-hold investing no longer works, or that diversification doesn’t provide benefits, or that markets will take 40 years to recover, or it’s now a stock picker's market because passive investing is dead. It’s never different. What should you do in a Bear Market? Below is our guide to both prepare for and survive a Bear Market. 1. Be prepared. Your portfolio should have enough risk to meet your financial goals, but not so much risk that a Bear Market causes you to lose sleep. Prepare ahead of time with an investment allocation that includes assets other than stocks. 2. Acknowledge your emotions. The “pain” from losses feels worse than the “joy” from gains. “Fight or flight” is a natural reaction to quickly make portfolio changes to “stop the bleeding.” When markets are volatile, try not to overreact in either direction. The fear of missing out (FOMO) can turn an investor into a trader. 3. Avoid mistakes. In volatile markets, the possibility for a “mistake” increases. Big mistakes, like selling into a crash, can easily be avoided. But opportunities for small mistakes are more prevalent when markets are changing quickly with large percentage daily swings in price. 4. Understand the irony of markets. The possibility of a drop in price, ironically, is highest when markets are richly priced at all-time highs. After a -20% decline, markets have de-risked. 5. Don’t think you are smarter than the market. Markets move too fast and in unpredictable ways during a Bear Market. Trying to get out and get back into the market has been shown to be a fool’s game. Missing the market’s best days has a dramatic impact on long-term results. And most of the market’s best days occur within Bear Markets. 6. Realize the difference in time horizon. Wall Street is focused on today, tomorrow, and this quarter. Their decisions are made within this short-term framework. Your investment horizon is next year, five years, and 25 years. Your long-term time horizon can allow you to take advantage of Wall Street’s shortsightedness. 7. Accept that nobody knows. Last week, on April 9th, Goldman Sachs called for a recession as their “base case” economic forecast. Seventy-three minutes later, they reversed their call, downgrading their projections of a recession. That same day, on April 9th, the S&P 500 gained 9.5% over the course of four hours. Either the long-term fundamental value improved by $4.5 trillion, or nobody really knows. 8. Realize that nobody rings a bell at the bottom. You won’t know that was “it” until much later. Concede that investment decisions take time to reach maturity and may go down before they go back up. 9. Bear Markets have tended to be shorter than bull markets. The average Bear Market typically lasts 11 months from top to bottom. However, the time it takes to recover from losses varies based on the severity of the Bear Market. The 2020 COVID Bear Market took five months to recover. The 2000 Dot-Com Bear Market took seven years. 10. Turn the TV off. Television, financial news, and social media are all designed to drive engagement. They do not have your best interest in mind. 11. Know where your cash is. Line up cash to meet your spending needs for the next year or two. This creates peace of mind to avoid having to raise cash in the midst of a downturn and de-risks the portfolio. 12. Stay diversified. Different assets respond differently in Bear Markets, reducing dramatic swings in the value of the overall portfolio. 13. Watch your allocations. Wide swings in values will move your portfolio out of line with the targeted allocations. Rebalancing keeps your risk in line with targets. Consider smaller, more frequent rebalancing to minimize the risk of bad timing. 14. Dollar cost average. This is the process of investing a certain amount of money at regular intervals, regardless of the market price. If you are in the Accumulation phase, Bear Markets provide an opportunity to purchase more shares at a lower cost. This same principle can be applied when withdrawing funds from the portfolio through portfolio sales occurring at regular intervals, regardless of the market price. 15. Tax loss harvesting. Sell a position for a tax loss, use the loss to first offset gains generated elsewhere in the portfolio, then deduct up to $3,000 against other income. Additional losses can be used in future years. Use the proceeds from the sale to replace the original position in something different that still provides market exposure. Watch out for the Wash Sale Rules. 16. IRA to Roth conversions. Converting a Traditional IRA into a Roth IRA in a down market lowers the tax cost of the conversion and shifts gains from a market recovery into the Roth account to grow tax-free. 17. Super fund 529 plans. You can fund five years’ worth of gifts into a 529 plan for education all at once, without concern of incurring gift tax, by electing to treat the contribution as if it were spread over five years. The hope is a recovery in investment markets accrues to beneficiaries. 18. Front load your 401(k) contributions. Pulling forward contributions into your 401(k) plan that you would have normally made throughout the year allows you to invest more in a market with depressed prices. But before you do, double-check how the company matching works to avoid missing out. 19. Take advantage of the dislocation. Time is the only variable you cannot control when compounding money. Time waits for no one. But Bear Markets are like a time machine, offering opportunities to make investments at prices you wish you had years ago, before the start of the last bull market. If you made it to the end of this article, thank you! If our thoughts above resonated with you, but it sounds like something a professional should be handling for you, get in touch with us to discuss how Highland can help you. All content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. Nor is it intended to be a projection of current or future performance or indication or future results. Opinions expressed herein are solely those of Highland Investment Advisors, LLC and our editorial staff. The information contained in this material has been derived from sources believed to be reliable but is not guaranteed as to accuracy and completeness and does not purport to be a complete analysis of the materials discussed. All information and ideas should be discussed in detail with your individual adviser prior to implementation. Advisory services are offered by Highland Investment Advisors, LLC a SEC Investment Advisor.

Below is a summary of the first-quarter 2025 market performance and economic commentary. The full market performance report (PDF) , including commentary and charts, can be found here . Market Performance 📉The US equity market posted negative returns for the quarter and underperformed both non-US developed and emerging markets. Value outperformed growth and small caps underperformed large caps . 📈REIT ( real estate investment trusts) indices outperformed equity market indices. 📉 Within the US Treasury market, interest rates generally decreased during the quarter. The yield on the 10-Year US Treasury Note decreased 0.35% to 4.23%. 📈The Bloomberg Commodity Total Return Index returned +8.88% for the first quarter of 2025.

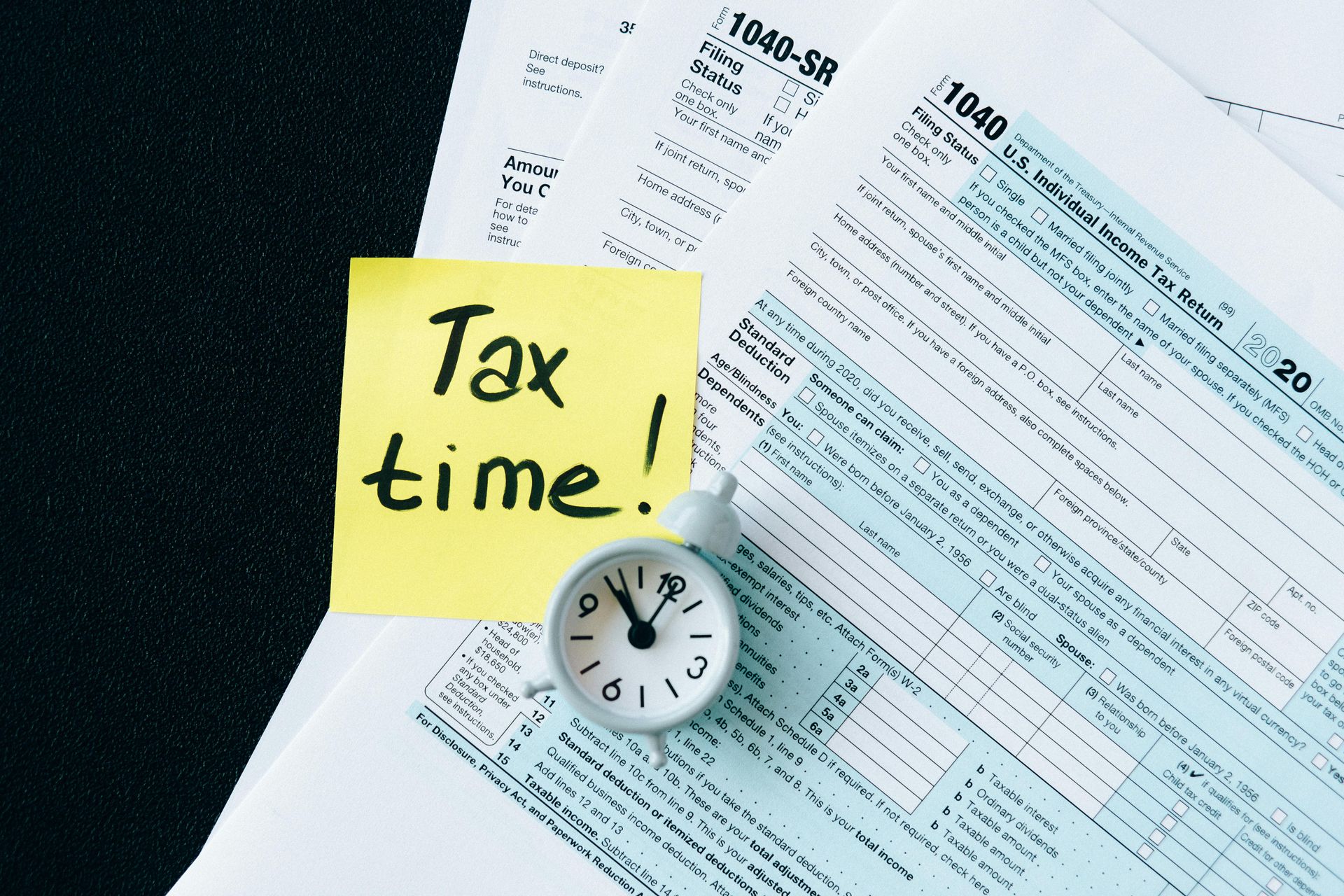

By: Ryan Moran, CFA, CPA, CFP® It is that time of year. Again. Tax season. A strategic approach can help reduce tax liability and even increase potential refunds. However, navigating the complexities of the tax code can be overwhelming, and missing out on valuable credits or deductions could mean leaving money on the table. That’s why working with a qualified tax professional—such as an Enrolled Agent (EA) or Certified Public Accountant (CPA)—alongside your financial advisor is essential. A tax professional can ensure you’re taking full advantage of available credits and deductions while aligning your tax strategy with your long-term financial goals. In this article, we’ve highlighted some of the most common tax credits and deductions that are available for 2024. The hyperlinks within the article will direct you to the relevant IRS source. Feel free to share this article with your tax professional. If you don’t have one, give us a call, and we’d be happy to recommend one. Tax credits are dollar-for-dollar reductions in your total tax liability, and in some cases, may increase your refund. The Earned Income Credit is available if your income is low and/or you have children. The Child Tax Credit is up to $2,000 per child under age 17 for married couples making less than $400,000 or single taxpayers making less than $200,000. If you pay for someone to care for your child or dependent, you may be eligible for the Child and Dependent Care Credit . This applies to children under age 13 and other dependents who are unable to care for themselves and live with you for more than half the year. The credit is up to 35% of qualifying expenses, to a maximum of $3,000 for one or $6,000 for two or more children or dependents. A credit is also available for costs associated with adopting a child. There are two education credit programs available for eligible post-high school tuition. The first education-related credit is the American Opportunity Tax Credit , which offers a maximum annual credit of $2,500 to offset tuition for an eligible educational institution, often reported to you on Form 1098T. Students are eligible for four years of this tax credit. The second education-related credit is the Lifetime Learning Credit , worth up to 20% of the first $10,000 of qualified post-high school education expenses, up to $2,000. Students do not need to be pursuing a degree or other credentials, meaning online classes and job improvement courses may be eligible. The Energy Efficient Home Improvement Credit can help homeowners offset qualifying improvement expenses for exterior doors, windows, air conditioners, water heaters, and furnaces. Similarly, the Residential Clean Energy Credit is for solar or wind generation, solar water heaters, and battery storage. If you purchased a new or used clean vehicle —such as an electric car—you may be eligible for a credit of up to $7,500. There is a credit for making contributions to an IRA or employer retirement plan. The Retirement Savings Contributions Credit is 50%, 20%, or 10% of your contributions, but phases out completely once your income is above $76,500 if married or $38,250 if single. Students and dependents are not eligible. The Premium Tax Credit helps offset the premiums of purchasing health insurance through the Health Insurance Marketplace. This is particularly helpful for families in early retirement, before being eligible for Medicare. The amount of this credit is significant and can be received in advance to lower monthly insurance premiums. The Foreign Tax Credit offsets taxes paid to a foreign country on income also subject to US tax. This is more common than you may think. Frequently, international investments, through structures like mutual funds and ETFs, pay this tax and report it to you via the Form 1099. If you paid more than $10,453 Social Security tax in 2024, per person, any excess is refunded via a tax credit. This may happen if you made more than $168,600 last year, maybe spread over multiple employers. Although not a credit, interest income received from US Treasury bonds is exempt from state income taxes. This percentage is frequently reported by mutual funds and ETFs, but you need to look it up yourself. It may not be reported to you on the Form 1099. And you need to make an adjustment on your state tax filings. Speaking of state tax filings, if you have investments in tax exempt municipal bonds or funds, make sure you adjust for any interest received from in-state issuers. That interest may also be exempt from state tax. Wisconsin, for example, offers a $300 credit for property taxes or rent paid. Check with your state for similar credits. Tax deductions are different from tax credits-they reduce your taxable income. The 2017 Tax Cuts and Jobs Act (TCJA) removed most tax deductions available to individuals, particularly some “itemized deductions” which were replaced with a much larger “standard deduction.” But some options are still available. Contributions to employer-sponsored retirement accounts, such as a 401(k), are considered tax deductions, along with Traditional IRAs. Highland Investment Advisors can guide you on the contribution limits to these types of accounts. If your taxable investment portfolio incurred capital losses , you can deduct up to $3,000 from your income after offsetting any capital gains you may have realized. Additional losses can be used in subsequent years. If you sold your home for a profit, up to $500,000 of gains are excluded from tax, if married, or $250,000 if single. Contributions to Health Savings Accounts (“HSAs”) are particularly powerful. For 2024, contributions up to $8,300 are tax deductible for a family. Earnings within the account are tax exempt. So are withdrawals used for eligible medical expenses. HSAs are “triple tax-exempt.” Teachers can deduct up to $300 for certain unreimbursed classroom expenses. Wisconsin also offers a deduction from your taxable income for contributions to Wisconsin’s 529 College Savings plan. For 2024, the deduction is up to $5,000 of contributions per beneficiary. For 2025, the deduction increases to $5,130 per beneficiary. Most of these tax credits have limitations which may reduce the amount you are eligible for if your income exceeds certain amounts. All of these tax credits have a variety of eligibility requirements which need to be met. All content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. Nor is it intended to be a projection of current or future performance or indication or future results. Opinions expressed herein are solely those of Highland Investment Advisors, LLC and our editorial staff. The information contained in this material has been derived from sources believed to be reliable but is not guaranteed as to accuracy and completeness and does not purport to be a complete analysis of the materials discussed. All information and ideas should be discussed in detail with your individual adviser prior to implementation. Advisory services are offered by Highland Investment Advisors, LLC a SEC Investment Advisor.

Co-Authors: Adam S. Drake, CFA Scott Keipper, CPA/PFS Ryan Moran, CFA, CPA, CFP® Physicians and dentists spend years building their careers, balancing intense training, long hours, and patient care. But when it comes to managing their own finances, even the most successful doctors can run into challenges. Between complex tax laws, investment decisions, and insurance considerations, it’s easy to overlook key financial risks that could impact their future. While some doctors take a hands-on approach to their finances, without a structured plan, it can be difficult to align savings, investments, and tax strategies with long-term goals. Below are some common financial pitfalls that many doctors encounter—awareness of these can help avoid unnecessary stress down the road. M anage Cash Flow Wisely 💸 ⚠️Buying a home and cars that are too expensive early in their career. ✅Some doctors, eager to reward themselves after years of training, purchase high-cost homes or vehicles early in their careers, which can create financial strain. ⚠️Overspending each month and failing to invest enough. ✅Before buying a home or car, doctors should assess their overall financial picture, including student loans, savings goals, and future income potential. Making a purchase that fits within a sustainable budget can help build long-term wealth without unnecessary financial stress. C over Risks with Proper Insurance & Legal Advice 📝 ⚠️Purchasing permanent life insurance without understanding other options, like term insurance. ✅Doctors should consider how permanent life insurance stacks up to term insurance or other types of insurance in terms of cost and coverage. ⚠️Buying insurance from a captive agent instead of an independent agent. ✅Independent agents can offer a wider range of policies, while captive agents provide products from a single company. Understanding the differences can help in selecting the right coverage. ⚠️Lacking adequate disability insurance with proper “own occupation/specialty” coverage. ✅Doctors should ensure that their specific medical specialty is covered, and not assume they are covered and later find their policy does not protect them. ⚠️Not having sufficient personal umbrella liability insurance. ✅Having enough liability coverage could protect personal assets in the case of a lawsuit, for example. ⚠️Not having an estate plan with key documents. ✅Doctors should work with an estate planning attorney to establish key documents like a will, trust, and powers of attorney. Having a structured estate plan helps protect assets, ensure healthcare and financial decisions align with their wishes, and minimize complications for their family. ⚠️Not using a lawyer to review employment contracts. ✅A lawyer familiar with physician contracts can help identify provisions for pre-tax reimbursements and other financial benefits. ⚠️Signing a one-sided noncompete agreement that is overly restrictive. ✅Doctors should work with an attorney to evaluate noncompete agreements and negotiate fair terms. Ensuring the contract allows for career flexibility can help prevent restrictions that could limit future practice opportunities. A llocate Investments Strategically 📊 ⚠️Not saving enough in tax-deferred accounts early in their careers. ✅Doctors should consider the long-term benefits of contributing to tax-advantaged retirement accounts, while balancing the priorities of paying down student loans and growing lifestyle expenses. ⚠️Not funding a backdoor Roth IRA annually. ✅Some physicians who exceed income limits for direct Roth IRA contributions may be unaware of the backdoor Roth strategy as a potential option. It’s important to consider tax implications and IRS rules before proceeding. ⚠️Lacking tax diversification across three investment buckets (taxable, traditional, and Roth accounts). ✅Doctors might be able to maximize their tax planning opportunities in retirement with a mix of taxable, tax-deferred, and tax-free accounts. ⚠️Not utilizing a proactive accountant to identify financial and tax opportunities. ✅Working with an accountant who understands physician-specific tax considerations can help uncover deductions, credits, and planning strategies that might otherwise be missed. Consult with a qualified tax professional to determine what strategies are appropriate for your specific situation. T ake Control with a Financial Plan 🌳 ✅Understanding these common financial pitfalls is the first step in protecting your wealth and securing your future. A structured financial plan can help doctors align their finances with long-term goals. If you want to take a more strategic approach to your finances, give us a call. We’re here to help you navigate these challenges with clarity and confidence. Schedule a Meeting This article is for informational purposes only and should not be considered financial, legal, or tax advice. Consult with a qualified financial professional, attorney, or accountant before making any financial decisions. Investing involves risks, and past performance does not guarantee future results.

Below is a summary of the fourth-quarter 2024 market performance and economic commentary. The full market performance report (PDF) , including commentary and charts, can be found here . Market Performance 📈 The US equity market posted positive returns for the quarter and outperformed both non-US developed and emerging markets. Value underperformed growth and small caps underperformed large caps. 📉REIT ( real estate investment trusts) indices underperformed equity market indices. 📈 Within the US Treasury market, interest rates generally increased during the quarter. In terms of total returns, short-term US treasury bonds returned -0.83% while intermediate-term US treasury bonds returned -1.70%. The yield on the 10-Year US Treasury Note increased 0.77% to 4.58%. 📉The Bloomberg Commodity Total Return Index returned -0.45% for the fourth quarter of 2024.

Highland Investment Advisors LLC is committed to helping families achieve prosperity and peace of mind through: 1️⃣ Investment advice 2️⃣ Integrated financial planning 3️⃣ Tax minimization strategies As fiduciaries, we are fully aligned with the families we serve. 🤝 Highland specializes in guiding families in the rapid accumulation phase toward financial independence and working with retirees or near-retirees on effective distribution strategies. 📅 Schedule a 30-minute discovery call today to learn more: https://meeting.levitate.ai/#/landing/e66ead-8x6v2g

These are the cornerstones of our approach to portfolio management philosophy, ensuring your investments are aligned with your goals and built for long-term success. Simple, low-cost, and tax-efficient investing that focuses on long-term growth and minimizing unnecessary risks. Disciplined, diversified strategies designed to avoid costly mistakes and deliver consistent, market-based returns. Personalized portfolios that balance growth, risk reduction, and inflation protection to help you achieve your financial goals. Looking for a deeper dive on the principles that guide our investment philosophy? Continue below. Simple, Low-Cost, and Tax-Efficient We believe in keeping your investments simple, low-cost, and tax-efficient. By simplifying the process, you gain a clearer understanding of how your money is working for you. A highly diversified, low-cost strategy frequently generates better long-term results, allowing you to take on just the right amount of risk to achieve your goals. Avoid Costly Mistakes Successful investing is about avoiding common mistakes—chasing “hot” stocks, trying to time the market, or reacting emotionally to short-term news. Our disciplined approach helps you avoid these pitfalls and capitalize on long-term opportunities to grow your wealth. Reject Wall Street’s High-Cost Games We stay clear of Wall Street’s high-fee, complex products designed to generate profit for them, not for you. Our focus is on straightforward, transparent investment strategies that keep your costs low and your goals in sight. Passive Strategies Outperform Most active managers fail to consistently beat their benchmarks over time. We focus on achieving market returns through a passive, diversified approach, reducing unnecessary risk, costs, and taxes that eat into your returns. Maximize After-Tax Returns It’s not just about what you make—it’s about what you keep. Our strategies focus on maximizing after-tax returns by leveraging techniques like tax-loss harvesting, asset location, and rebalancing, all while minimizing taxable events. Smart Risk for Your Goals The right portfolio is one that takes on enough risk to help you meet your long-term financial goals, but not so much that it keeps you awake at night during market volatility. We carefully balance growth assets, risk reduction strategies, and inflation protection to match your risk tolerance and financial objectives. Know Your Investments’ Purpose Every investment has a role. Some aim for growth, some reduce risk, and others protect against inflation. We ensure that each piece of your portfolio serves its purpose, creating a balanced strategy that works for you over the long term. Global Diversification for Stability We invest globally to increase diversification and minimize risk. By holding a wide array of assets across geographies, your portfolio is less dependent on the performance of a few sectors or countries, providing a smoother path to growth. Risk Reduction Without Compromise Risk reduction strategies, like cash and bonds, form the foundation of your portfolio. These assets protect your wealth and help you weather volatility, but we carefully manage the risks associated with them, such as interest rate sensitivity and taxation. Use of Non-Correlated Strategies We include non-correlated assets and select alternative strategies when appropriate. These investments don’t move in line with traditional markets, providing additional diversification and stability. However, they come with tradeoffs, like tax inefficiency, so they are used thoughtfully.

We approach every client relationship with an open mind, free from preconceived ideas about what you should or shouldn’t do. That’s why we start by listening—taking the time to understand your situation through thorough fact-finding. By asking insightful questions, we gain clarity on your goals. Through open and honest dialogue, we help you prioritize what’s most important. During this stage, we also assess your ability and comfort with taking on risk. Next, we analyze your current investments and financial position to formulate a strategy tailored to you. From this, we create a purpose-driven, actionable plan. We ensure you are part of the process every step of the way—adjusting, confirming, and fine-tuning the plan until you’re completely comfortable with the recommendations. Only then do we move forward with implementation. Once the plan is in motion, our work doesn’t stop. We continuously monitor your progress, anticipate changes, and make adjustments as needed. Financial planning is an ongoing journey that evolves with you, ensuring you stay on track through every stage of life.

Successful ESTATE ADMINISTRATION means that your intentions are met and your family is cared for. Critical Questions Highland Can Help You Answer: What happens to my assets when I pass away? Who will oversee my estate and ensure my wishes are carried out? What does my Will actually specify, and does it reflect my current intentions? How should my accounts be titled to align with my estate plan? Who are my listed beneficiaries, and are my contingent beneficiaries up to date? Do I need a trust, and if so, what kind? How does life insurance factor into my estate plan? How can I approach conversations with my parents about their estate plan? Can my advisor work with my estate planning attorney to achieve better results? Smart TAX PLANNING Identifies Opportunities to Reduce, Defer, or Eliminate Taxes—Now and Over Your Lifetime Critical Questions Highland Can Help You Answer: How much am I currently paying in taxes, and where can I find savings? Are there strategies to reduce how much I owe? Am I contributing enough to my retirement accounts to maximize tax advantages? Are there any tax credits or deductions I qualify for? What does it mean to eliminate taxes, and how can it apply to my financial situation?

We are excited to announce the opening of our new office at 175 Patrick Blvd, Suite 120, in Brookfield, Wisconsin, effective December 1, 2024. This move unifies three previous Milwaukee metro offices into a spacious, modern location that enhances both client convenience and team collaboration. “This new Brookfield office is thoughtfully designed to serve our clients and provide a collaborative space for our entire team under one roof,” said Adam S. Drake, CFA, owner of Highland. “Our growth through strategic acquisitions, like Fund Management Corp. and Stoeckler Financial, along with our expanding advisory team made this new, combined office the next step in elevating our client experience.” Adam Stoeckler, CFP®, a financial advisor with Highland, added, “Our combined office builds a stronger in-person community among our advisors, fostering a culture of collaboration and innovation that ultimately benefits our clients and staff.” About Highland: Founded in 2006, Highland manages over $300 million in client assets. As a fee-only wealth management firm, Highland offers customized financial advice and solutions that cater to the unique circumstances and objectives of each client.