👉 4th Quarter 2024 Market Review

Below is a summary of the fourth-quarter 2024 market performance and economic commentary. The full market performance report (PDF), including commentary and charts, can be found here.

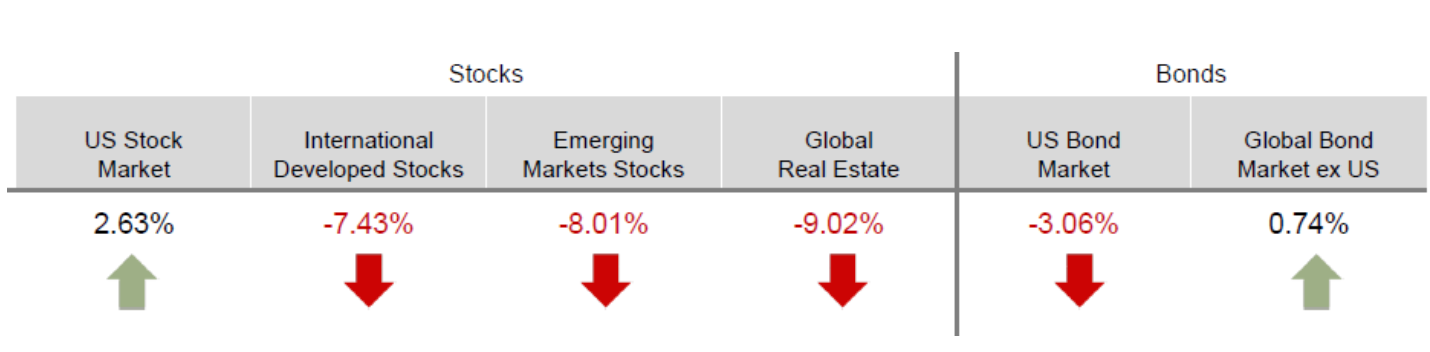

Market Performance

📈 The US equity market posted positive returns for the quarter and outperformed both non-US developed and emerging markets. Value underperformed growth and small caps underperformed large caps.

📉REIT (real estate investment trusts) indices underperformed equity market indices.

📈 Within the US Treasury market, interest rates generally increased during the quarter. In terms of total returns, short-term US treasury bonds returned -0.83% while intermediate-term US treasury bonds returned -1.70%. The yield on the 10-Year US Treasury Note increased 0.77% to 4.58%.

📉The Bloomberg Commodity Total Return Index returned -0.45% for the fourth quarter of 2024.

4Q24

Economic Overview

U.S. Inflation Eases, Housing Costs Persist 🏠

In 2024, the inflation rate dropped below 3%, marking an important milestone. While the Consumer Price Index (CPI) indicated a decrease to 2.4% in September, it rose back to 2.7% by November. Housing costs continue to pose challenges, as the real estate market, despite a cooling period, saw prices increase at a 3.4% annual rate in October. Sectors like housing and services continue to drive inflation metrics higher, though shelter prices may be stabilizing. Despite CPI and Producer Price Index (PPI) remaining above the Fed’s 2% target, market reactions were optimistic, suggesting an increased likelihood of a rate cut in December, and the Fed delivered on that optimism.

The Fed Meets Expectations, and Stirs Surprises 📊

The Fed cut the benchmark overnight lending rate at its December meeting by 0.25% (25 basis points), bringing the target rate to 4.25%-4.50%, meeting market expectations. The move came after a 50-basis-point cut in September and a 25-basis-point cut in November.

However, the Fed indicated that it is looking at two interest rate cuts in 2025 versus the four that it had projected at the September meeting. This shift created a surge in volatility across financial markets which led to a reversal in the U.S. stock market’s late-year rally.

The Labor Market Holds Strong 👷

The labor market remained tight, with an unemployment rate of 4.2% in December. The economic environment has bolstered consumer confidence, reflecting well in retail sales growth over recent months. The jobs data released in December was deemed as Goldilocks-like, revealing an increase of 227,000 jobs, which exceeded the Dow Jones consensus estimate of 214,000. In addition, the October jobs figure was revised upward by 36,000 following a disappointing performance the previous month. Recent job opportunities have seen notable increases in the health care, social assistance, and leisure/hospitality sectors.

Global Markets: Volatility and Dollar Strength 💵

Since September, the U.S. dollar has strengthened, and concerns over potential tariffs pushed the Morningstar Global Markets ex-US Index down by over 7.5% in the fourth quarter, though it managed a 5.7% gain for the year. The Morningstar Emerging Market Index fell 7.7% in the fourth quarter but gained 7.4% for the year, partly due to a rebound in Chinese stocks. The Morningstar China Index rose by 16.7% in 2024 after three years of negative returns.

Gold Shines Amid Global Uncertainty ✨

Investments in hard assets like gold and certain commodities performed well in 2024. Gold gained 27% due to persistent global tensions and Fed interest rate cuts.

As always, our focus remains on long-term goals and strategy, while keeping you informed of current market developments. If you have any questions or concerns, don’t hesitate to reach out. I’m always here as a resource for you. 📲 call us at 414-755-2309 x101.

Highland Exists to Promote Your Prosperity While Protecting Your Peace of Mind.